The Friends of the Oceanside Public Library was established in 1971, raising revenue through membership dues and special fundraiser events, and by operating used bookstores in the Library. The Friends of the Library and the Oceanside Public Library Foundation are separate non-profit agencies that work in tandem to benefit the Library.

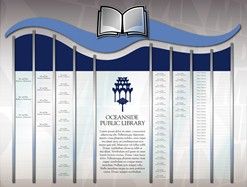

The Oceanside Public Library’s Donor Wall:

The Oceanside Public Library’s Donor Wall recognizes The Friends, the Foundation, and other groups and individuals who have made significant financial contributions to support the Library.

Gifts of any size are gratefully accepted, but donor wall recognition begins at the $1,000 level. Each category on the donor wall signifies a level of contribution.

Donor recognition is ongoing, and gifts may be made at any time. Records are kept for donations of $1,000 or more, and donors may move into higher recognition categories as they add to their donation total. Donors will receive a personal letter of acknowledgment and certificate of appreciation. All donations are tax deductible.

The Oceanside Public Library Foundation now accepts credit card donations over the internet — you can make a donation to the Foundation by clicking below! Alternatively, please see our section on donations and planned giving. The Oceanside Public Library Foundation is a 501(c)(3) charitable organization, and all donations are tax deductible.

Opportunities for planned giving

The OPL Foundation is a non-profit organization and your gifts are tax-deductible. There are many ways to contribute that can help you achieve your own financial and personal objectives, as you invest in the future of the Library.

A planned gift to the Oceanside Public Library Foundation is one way to structure your donation. You may choose to leave a portion of your estate to the OPL Foundation by naming it in your will or trust. These bequests offer flexibility and may reduce estate taxes.

The OPL Foundation also welcomes gifts of various types of assets such as securities, life insurance policies, U.S. Savings bonds, or other property. Talk to your attorney or tax advisor about how a gift to the OPL Foundation may help you realize tax savings for yourself or your heirs.

To further enhance its abilities to accommodate the individual desires of donors, the OPLF in 2006 joined the San Diego Foundation, a community resource for receiving, managing, and distributing charitable funds to support organizations within the San Diego region.

For more information about the OPL Foundation, or how to make a donation, please contact the Library Director at (760) 435-5560.